The 5 I’s: A Business Owner’s Guide to Smarter Financial Decisions and Sustainable Growth

Running a business means making decisions every single day—about people, products, pricing, operations, and your own time. But as the business grows, those decisions get more complex. The stakes get higher. The margins for error get thinner.

So, how do you know you’re making the right call?

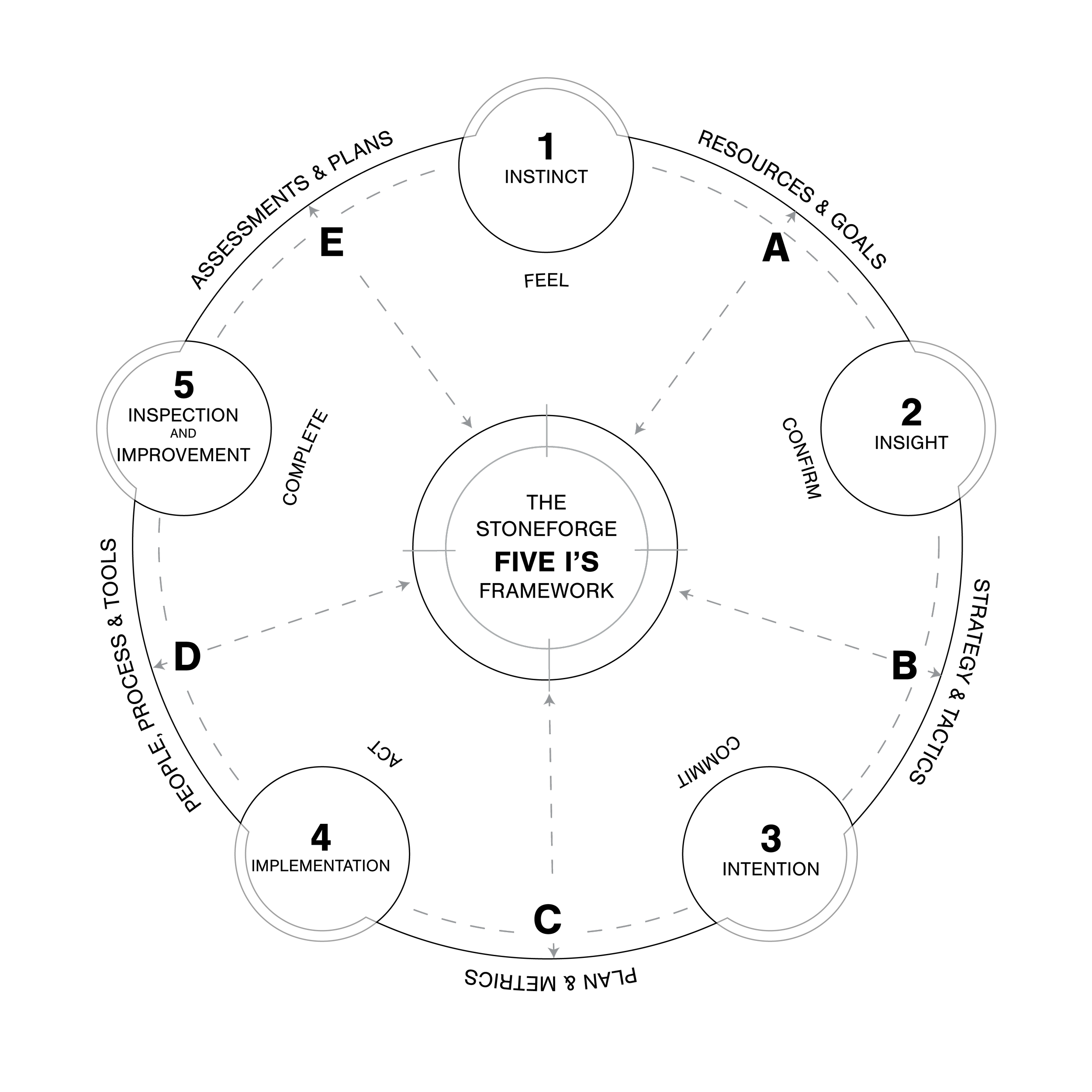

At Stoneforge Consulting Group, we believe numbers should guide your business—not just report on it. That’s the foundation of our work as Fractional CFOs and business consultants, and it’s why we created the 5 I’s Framework—a structured yet flexible way to lead your business through uncertainty with clarity, confidence, and control.

This framework, featured in our book The Numbers Expedition: The Importance of Numbers in Your Company’s Future, is built from decades of real-world experience with companies just like yours—from startups to scale-ups to multi-generational businesses in need of a reset.

Why Most Business Owners Feel Stuck at Some Point

Here’s what we’ve learned: Most business owners don’t lack ideas or drive. What they lack is a way to:

• Validate what’s working (and what’s not)

• Make financially smart decisions in the moment

• Turn insights into action—without wasting time or money

• Grow without flying blind

The 5 I’s help you do exactly that.

The 5 I’s: Your Decision-Making Compass

This framework gives you a repeatable way to lead your business through challenge and growth. Think of it as your compass—a way to get your bearings and keep moving forward, no matter how complex things feel.

1. Instinct

Start with your gut—then ground it in reality.

Every business starts with a feeling. You saw a need, had a vision, took a risk. That instinct is still valuable—it helps you read your market, make fast calls, and lead with conviction. But over time, instinct without structure becomes guesswork. You start second-guessing. Decisions pile up. Things slow down.

Ask yourself:

• Am I making decisions from instinct or evidence?

• Where am I guessing when I could be measuring?

How to apply it:

Keep trusting your gut—but validate it with real numbers. If you think a product is a hit, check the margin. If you feel like a client is draining your team, dig into the hours and profit. Use instinct to point the way, then use data to decide.

2. Insight

Turn numbers into meaning.

Most businesses collect data—revenue, expenses, customer churn, hours worked—but few turn that into real insight. You don’t need more spreadsheets. You need better questions.

Ask yourself:

• What are my financials really telling me?

• Do I understand which parts of the business are driving (or dragging) profit?

How to apply it:

• Run a client-by-client margin analysis. See which relationships are profitable, and which need to be restructured or sunset.

• Review your product or service mix. Which offerings have the highest ROI? Which take the most resources for the least return?

• Build a dashboard (even a basic one) that tracks what truly matters: net cash flow, gross margin by line of business, days to collect, or utilization by team.

One of our clients thought their newest offering was the future. But insight revealed it required 3x the labor for less than half the profit. That clarity helped them double down on what actually worked—and revenue jumped 40% in six months.

3. Intention

Stop reacting. Start directing.

Once you have clarity, the next step is to be intentional. What’s the real plan? Are your goals aligned with your numbers, your capacity, and your team?

Too often, we see businesses caught in reaction mode—chasing revenue, constantly hiring, stuck in a cycle of “more.” Intention means saying, this is where we’re going, and aligning everything around that.

Ask yourself:

• What’s the vision—and do my actions match it?

• Am I growing for growth’s sake, or with purpose?

How to apply it:

• Set 12-month financial and operational targets—and share them with your team.

• Tie your budget to your goals (not just last year’s spend).

• Say no to work that doesn’t serve your long-term strategy.

4. Implementation

Make it real.

Strategy without execution is just a dream. This is the step where things actually change—pricing gets updated, processes get improved, forecasts get built, communication gets clearer.

Here’s the key: implementation doesn’t have to be perfect. It just has to happen. Most companies stall here because they overcomplicate it or wait for more certainty. But clarity comes from action.

Ask yourself:

• Where are we stuck in planning, but not doing?

• What small steps can we take to move forward now?

How to apply it:

• Schedule a monthly financial review with your leadership team (not just your bookkeeper).

• Update your billing process to reduce cash delays by even a few days.

• Assign ownership—who is responsible for that forecast, that report, that margin improvement?

In one company we supported, a simple shift in project scoping (based on margin insight) led to a 22% improvement in profit—without hiring a single person. It just required the will to implement.

5. Inspection & Improvement

Review, reflect, and refine—constantly.

Once the wheels are in motion, don’t set it and forget it. What worked last quarter might not work this one. Great companies are built on continuous improvement, not one-time wins.

This last step closes the loop. It’s how you build momentum. It’s how you learn. And it’s how you stay accountable—to yourself, your team, and your goals.

Ask yourself:

• What are we measuring consistently?

• Where are we improving—and where are we stuck?

How to apply it:

• Build a monthly rhythm for reflection: What’s working? What’s not? What’s next?

• Use dashboards and KPIs that actually tie to performance and decision-making.

• Involve your team—financial clarity should not live in a silo.

Why This Framework Works

The 5 I’s aren’t just theory. They’re the method we use as Fractional CFOs with every client we support—across industries, growth stages, and business models.

Why? Because they give you:

• A structured yet flexible way to lead

• A financial system that evolves with you

• A way to connect vision with execution

• A smarter approach to risk, investment, and growth

And most importantly, they help you lead with confidence—even in the face of uncertainty.

You Don’t Need a Full-Time CFO to Think Like One

This framework is simple, but powerful. And you can start using it right now.

If you’re tired of flying blind, if you’re trying to scale, or if you just want to feel more in control of your numbers—this is your path forward.

We’d love to walk it with you.