The Stoneforge Five I’s:

A Business Owner’s Guide to Sustainable Growth

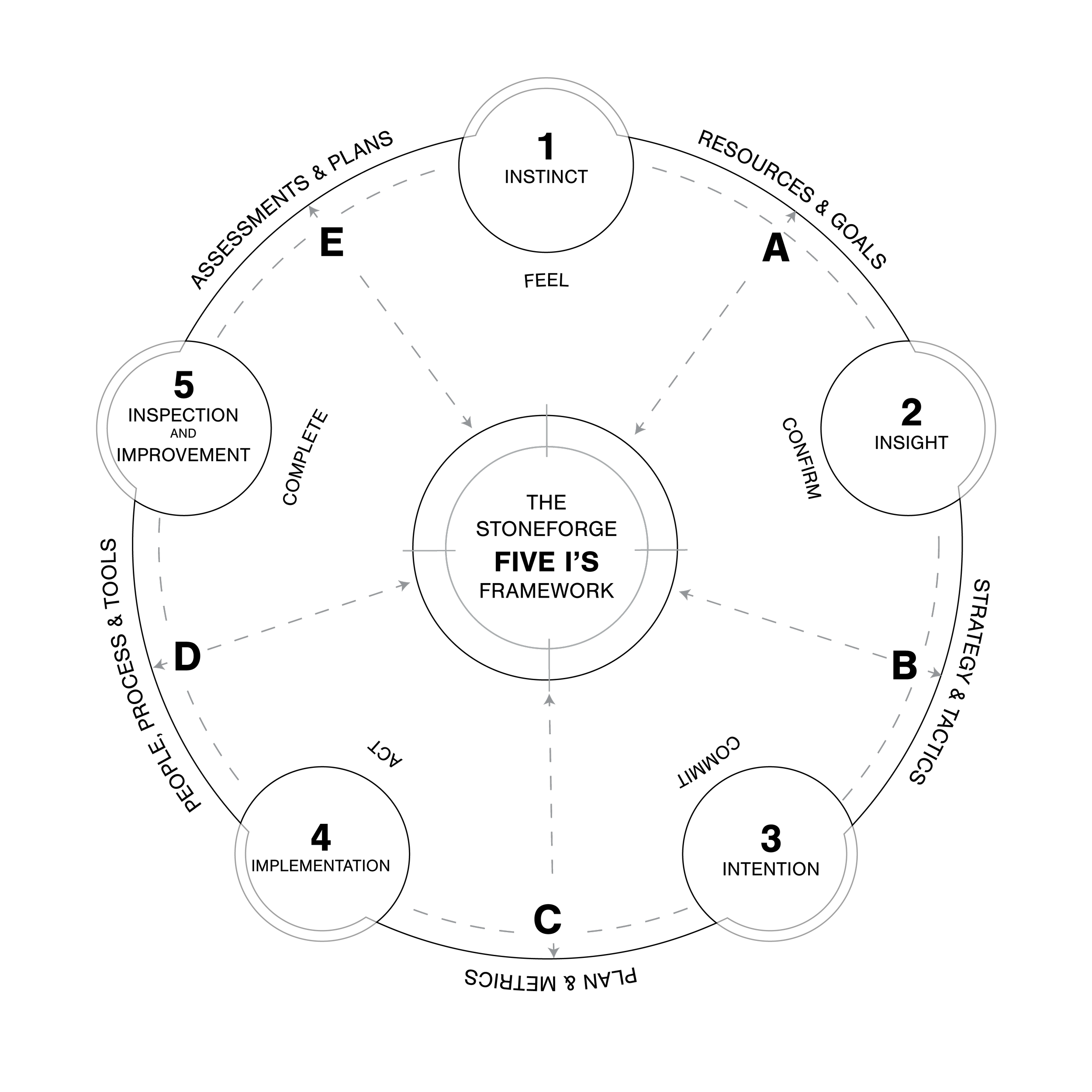

5 I’s

If you’ve ever felt like you’re making decisions in the dark—or worse, reacting to yesterday’s problems with no time to think about tomorrow—you’re not alone. Most business owners reach a point where instinct and hustle are no longer enough. That’s where financial clarity becomes a competitive advantage.

At Stoneforge Consulting Group, we’ve spent decades helping companies navigate complexity with confidence. The key? A framework that brings structure to your decisions without slowing you down. We call it the 5 I’s Framework, and it’s the heart of our book, The Numbers Expedition: The Importance of Numbers in Your Company’s Future.

This framework isn’t just a way to organize your thinking—it’s a tool you can use to:

• Make smarter, faster decisions

• Align your team around what really matters

• Grow your business without losing control

Let’s walk through it—step by step—with real examples and practical ways to apply it in your own company.

Step 1: Instinct

Start with what you feel. Then ground it in what you know.

Every business begins with a feeling. A gut decision. An insight no one else acted on. Your instincts are part of what makes you a successful founder or leader—they’re the spark.

But as the business grows, the stakes change. It’s no longer just about reacting—it’s about leading. And instincts, while powerful, aren’t enough without structure.

Ask Yourself:

• Where am I relying on gut instinct without supporting data?

• Do I feel confident making strategic decisions—or am I guessing?

Example:

You believe your most loyal customers are those who buy your premium product. But when you look at the data, you see that repeat purchases and referrals are actually coming from a lower-cost service you almost stopped offering. That’s instinct + insight in action.

Try This:

• Write down your “gut feelings” about what’s working in your business.

• Then pull a few key metrics to validate—or challenge—those beliefs.

• Start seeing your instinct as a starting point, not a final answer.

Step 2: Insight

Look at the numbers—but more importantly, see what they’re telling you.

Insight is where data becomes clarity. It’s the step where you stop swimming in spreadsheets and start spotting patterns, trends, and anomalies.

You don’t need to become a financial analyst. But you do need to know how to ask the right questions—and understand the answers.

Ask Yourself:

• Which parts of my business are truly profitable?

• What’s draining time, money, or energy without a return?

Example:

You’re seeing strong top-line growth—but your cash is tight. When you dig into the numbers, you realize your accounts receivable are 45 days behind on average, and you’re paying your vendors in 15. Insight helps you adjust terms, free up cash, and sleep better.

Try This:

• Run a margin analysis by product, service, or client.

• Look at revenue and cost of delivery—what’s the real return?

• Spot hidden profit leaks—like scope creep, underpriced work, or operational inefficiencies.

Pro tip: You don’t need 100 metrics. You need 5 that actually matter. Focus on clarity, not complexity.

Step 3: Intention

This is the turning point. With clear insight, you now have the power to lead with intention.

Too many business owners run on momentum. They chase growth, launch products, and hire teams without pausing to ask: Is this taking us where we want to go?

Intention is about deciding where you’re going, why it matters, and what needs to change to get there.

Ask Yourself:

• What’s my strategic focus for the next 6–12 months?

• Do our resources align with our priorities?

• What should we stop doing to stay focused?

Example:

You want to scale a subscription service that’s working well. But your sales team is still incentivized to close one-off projects. Intention means shifting comp plans, messaging, and resourcing to support the business you want to build—not just the one you’ve always had.

Try This:

• Set 1–3 clear business goals and tie them to financial outcomes.

• Align your budget to your strategy—not last year’s numbers.

• Communicate your intentions to your team so everyone rows in the same direction.

Use your insight to set a direction. Lead on purpose—not by accident.

Step 4: Implementation

You’ve got clarity. You’ve got intention. Now it’s time to roll up your sleeves.

This is where many companies stall. Implementation is the messy, real-world part—where financial models become new workflows, pricing changes get rolled out, and strategy moves from the whiteboard to the front lines.

But here’s the good news: you don’t have to overhaul everything at once. Progress is more important than perfection.

Ask Yourself:

• What’s the first small step I can take to move this forward?

• Who owns this, and when will it be done?

Example:

Your team agrees you need better forecasting. Implementation means assigning someone to build a 12-month cash forecast, reviewing it monthly, and adjusting it based on reality—not just hope.

Try This:

• Choose one initiative to implement this quarter (e.g., a new margin target, dashboard, or SOP).

• Assign clear ownership and check-ins.

• Track progress and celebrate wins—even the small ones.

Implementation isn’t about doing more—it’s about doing the right things, on purpose, with discipline.

Ideas are great. Action is better. Make the plan real.

Step 5: Inspection & Improvement

Don’t just act. Reflect, learn, and get better—every month.

The final step in the 5 I’s is what makes everything sustainable. Inspection is about creating a rhythm of reflection, measurement, and adjustment. It’s where accountability lives—and where improvement starts.

This is how high-performing companies stay agile, profitable, and focused—even in a fast-changing market.

Ask Yourself:

• What are we reviewing regularly?

• What metrics actually help us make decisions?

• Where are we improving—and where are we slipping?

Example:

You hold a monthly leadership meeting where you review revenue, margin, utilization, and forecast accuracy. You catch a drop in delivery efficiency early and adjust before it impacts client satisfaction or profit.

Try This:

• Set a recurring calendar for reviewing key numbers and initiatives.

• Use real-time dashboards that track what matters (e.g., cash, pipeline, margins).

• Build a culture where your team is comfortable learning and adjusting, not just hitting targets.

Putting It All Together: Leading with the 5 I’s

Here’s what makes the 5 I’s so powerful: it’s not just a one-time fix—it’s a cycle you can use again and again as your business grows and evolves.

It helps you:

• Start with what you know (instinct)

• Validate it with facts (insight)

• Choose your direction (intention)

• Make it real (implementation)

• Get better over time (inspection & improvement)

This is how you move from reactive to proactive. From overwhelmed to in control. From “I hope this works” to “I know where we’re going and why.”

You Don’t Have to Go It Alone

If you’re ready to move past the chaos and lead your business with more confidence, clarity, and control—the 5 I’s are here for you. And so are we.

As your Fractional CFO and strategic partner, we help you apply this framework directly to your business—bringing financial clarity, operational alignment, and a proven process to every decision.

Let’s turn your numbers into your greatest asset.

Contact us.

contact@stoneforgegroup.com

(941) 231-1971